Why should you consider investing in notes? I’ll give you six reasons to consider, along with two real-life case studies that display the true power of this strategy.

#1: Note investing can provide you an investment vehicle not tied to Wall Street’s ups and downs.

Now, I’m not as anti-Wall Street as some are. Being exposed to the traditional markets certainly has its advantages. The stock market has produced average returns of about 10% historically, which is pretty solid. And stocks are extremely liquid. If you need cash for an emergency tomorrow, you can sell your stocks with the press of a button.

However, you may not want to hitch your entire retirement wagon to the traditional model. Take a look at Vanguard’s stated outlook for stocks and bonds for the next decade. It’s not encouraging, to say the least. Not to mention, the stock market inherently comes with an ever-increasing level of volatility. Timing the market has been proven to be an exercise in futility.

So, why not invest at least some of your money in an asset class that is much less talked about but has been fruitful for a very long time? Why not invest in real-estate debt? You can become the bank.

#2: Note investing can give you both control and safety.

Note investing gives you a path to controlling your investments, as opposed to simply allowing someone else to babysit your money and forcing you to tether your financial future to the whims of the stock market.

Many people are unaware just how easy it is to open a self-directed IRA (or 401(k)). If you have a traditional or Roth IRA, you can easily move some or all of your funds over to a self-directed IRA (traditional or Roth) and take control of your retirement. Aside from a few restrictions, there is a lot of freedom to this path. You can invest in nearly anything. I recommend investing in something you can understand, and with someone you trust if you decide not to go it alone.

And when it comes to safety, just how much collateral does Wall Street offer you for investing in stocks? In other words, if you invest in Apple, and the tech giant’s stock takes a nose dive, what is your recourse? The last time I checked, you have none. You may get a tax write-off for your losses but that’s not a sound investment strategy, in my opinion.

#3: Note investing can allow you to help people.

When you become the mortgage lender, you can work with the borrower to help them keep their home. Or you can gracefully help them to face the reality of the situation: that they may be in over their head, meaning they should relocate or find a better long-term plan than hanging on to a problem property.

Here are two case studies that illustrate how this can happen.

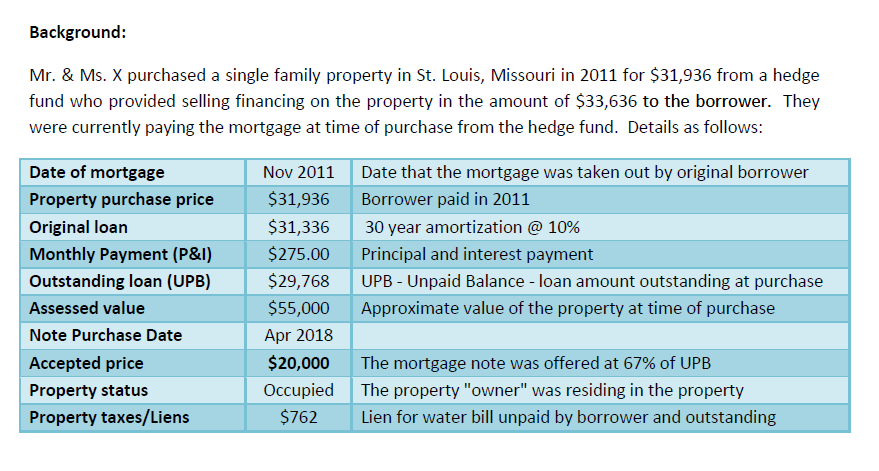

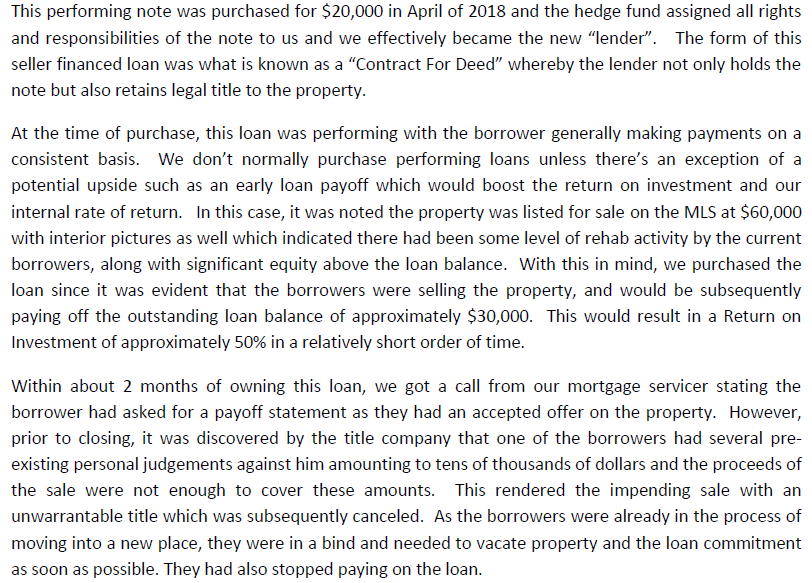

Case Study #1

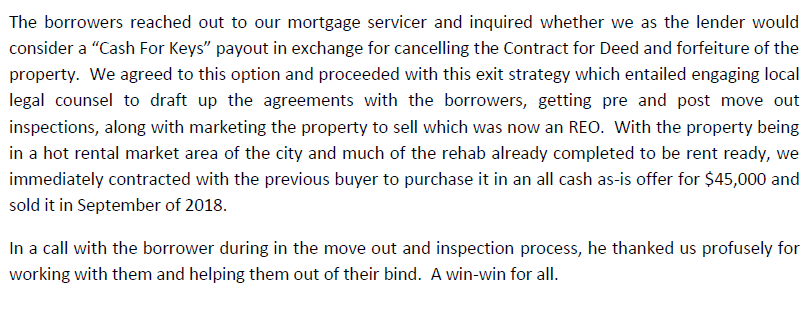

This is a true story, from fellow note investor Chad Urbshott at EquiGrowth Capital. Chad is an experienced note investor and his company has a strong track record. Now, not every note that EquiGrowth purchases turns out like this one, but this is an example of a true win-win.

Case Study #2

Here is another success story, this one from Bob Malecki. I first heard Bob on the BiggerPockets podcast, an episode that truly piqued my interest in note investing. I then had the pleasure of meeting Bob and his partners at a note-investing symposium in Las Vegas in early 2018.

The video of this outstanding case study can be accessed here. At the 13:30 mark, Bob takes about 4 minutes to outline our second case study, another true win-win brought to us by the world of note investing.

#4: Note investing can prepare you to invest when the next recession hits.

Warren Buffet famously said, “Be fearful when others are greedy and greedy when others are fearful.”

Let’s face it, real estate markets are cyclical. And most business economists predict the U.S. will fall into a recession within the next two years. Further, Americans are in more debt now than they were just after the 2008 financial crisis.

This isn’t meant to scare you, but my guess is that the number of mortgages in default will rise in the coming years. While I don’t celebrate this prediction, I do think it prudent to position yourself to help both your own financial situation as well as struggling homeowners. And you can do this while the stock market fails to keep pace.

#5: Note investing can provide you the option of working from anywhere.

If you want to turn your note investing into a side hustle or even a full-time business, you can do so from anywhere, provided you have a cell phone and internet access. Let’s not pretend note investing does not take work. It does. But it’s not the kind of work that requires you to manage tenants and toilets, and it does not anchor you to a specific location. It really can be done from anywhere.

#6: Note investing can give you bragging rights at parties.

In the last decade, investing in real estate has become very popular. Thanks to HGTV flipping shows as well as legitimate investors’ stories (Okay, there are some legitimate investors on TV.), real-estate investing has become quite trendy. And it’s also very popular to be considered an entrepreneur. Becoming a note investor is the perfect way to be both a real estate investor and an entrepreneur!

Now, if you don’t have the time or inclination to get overly hands-on with this investment strategy, you can certainly partner with an experienced investor. Don’t hesitate to reach out.