“It’s much more passive that traditional real estate investing” is a phrase you might see or hear when starting your research into the world of note investing. I mean, after all, you don’t have to deal with tenants, toilets, and trash. However, just as real estate investing ranges from Very Passive (investing in REITs) to Very Active (rehabbing, flipping, wholesaling), note investing has a broad spectrum of passiveness that can be tailored to all types of investors.

One thing that should be addressed up front is understanding your personal goals before thinking about the type of note investing you should participate in. Are you someone who is heavily invested in the stock market and simply wants to diversify with an asset class backed by a hard asset like real estate? Or perhaps you’re someone who finds the concept of note investing intriguing enough to pursue it as a side business? Or maybe you’re a seasoned real estate investor looking to switch from raising capital for apartment buildings to starting a fund that purchases hundreds or even thousands of notes at a time.

Regardless of your current situation, you need to clearly understand your goals before deciding on an initial note investing strategy. Before we dive into the details, it is worth noting that the definition of “passive” for the purpose of this article is the amount of time an investor will spend in managing their investment or business. Note investing can be done remotely through a phone and a computer, so one could argue it is never physically demanding and therefore it is always passive; however, depending on the strategy you’re using it can require significant time investment.

———

The Stages of Passiveness

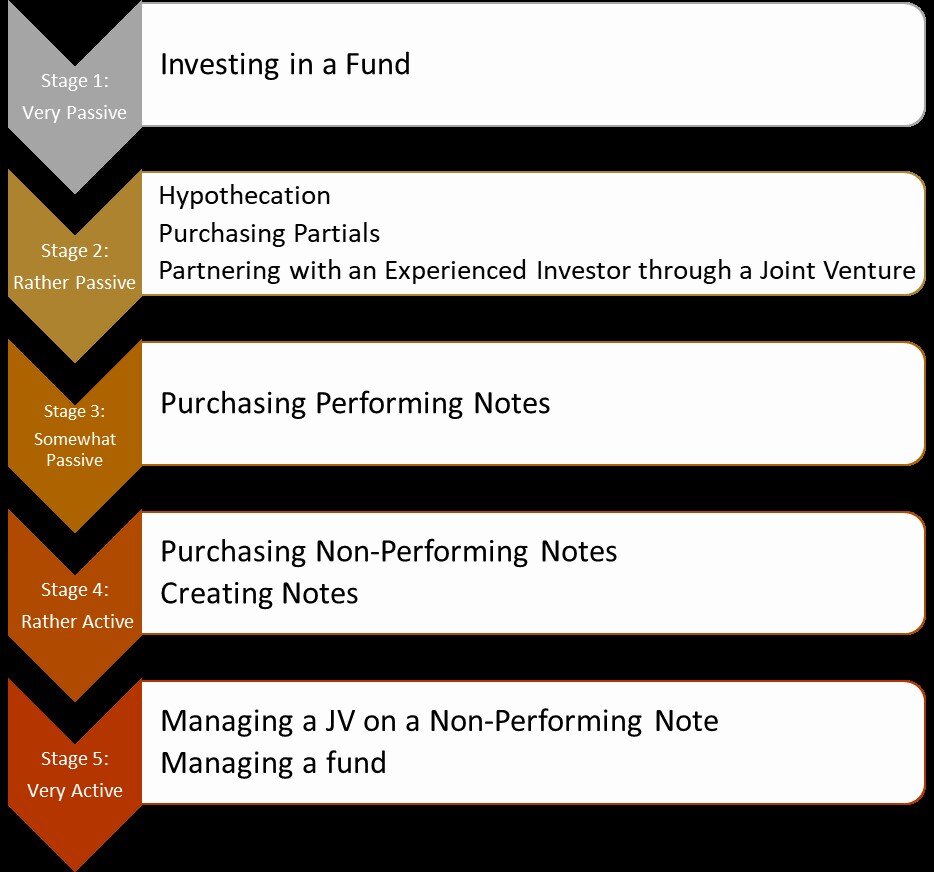

The figure above is a representation of the different stages of note investing passiveness ranging from Very Passive (Stage 1) to Very Active (Stage 5). Within these different stages exist various note investing strategies for an investor to utilize. This is not necessarily an all-encompassing list, but it does represent the most common ways that investors profit from notes.

Further, these stages aren’t intended to represent a chronological sequence for someone that wants to start investing in notes (i.e., start in Stage 1 and work your way to Stage 5). Rather, they are meant to represent the spectrum of passiveness for the investor. There are many experienced note investors that utilize the strategies of multiple stages. Now we will go into a more detailed explanation of the strategies listed above.

Stage 1: Very Passive

Strategy: Investing in a Fund

The first strategy is investing in a note fund. This is probably the most passive way that an individual can invest in notes. The fund structure can vary, but typically the investor is providing capital for an equity stake in an LLC that will purchase many individual notes. Although the JOBS Act of 2012 allowed for increased access to fund investing for those who may not have qualified previously, this approach is often open only to accredited or sophisticated investors and can require a substantial minimum investment. (Note: the definition of an accredited investor has recently changed, please see the link here.)

One of the benefits of investing in a fund is that it is Very Passive for the investor as they are not managing any of the day-to-day operations of the fund. Also, because the day-to-day operations are taken care of, the investor doesn’t usually need to have expertise in the note investing business to realize strong returns that are not correlated with the stock market. If you’re an accredited or sophisticated investor looking to diversify your portfolio outside of Wall Street and don’t have the time or desire to learn the ins and outs of note investing, consider researching note funds.

Jamie’s comments: We have personally invested in a few different note funds, including one of Dave Van Horn’s PPR funds. If you have more money than time and you aren’t looking to learn a ton about notes, investing in a fund can be a great choice.

Stage 2: Rather Passive

Two strategies for Rather Passive note investing are hypothecation and purchasing partials. These two strategies are quite similar and are compared in detail here. For the purpose of this post, we will keep it short and simple.

Strategy: Hypothecation

Hypothecation is the use of an existing note as collateral for a new loan. For example, if a seasoned note investor has a solid performing note, they use that performing note as collateral to obtain a loan from another investor. In this case because we’re talking about a Rather Passive strategy, as you would be the one that would loan capital to the seasoned note investor. This is more active than fund investing for a few reasons. First, you need to know individuals that are in the note industry that have performing notes that they want to use as collateral. Second, even though you don’t initially own any notes, there is the potential to obtain ownership of the note if the terms of the loan contract aren’t followed.

It is also possible that you could end up with the property itself through foreclosure or other means if the note becomes non-performing. That’s why it is critical that–before you participate in a hypothecation deal–you understand: the details of the asset that is serving as the collateral, the experience level and reputation of the investor you are loaning money to, and the verbiage in the contract between the two of you. If everything goes smoothly you’ll simply receive monthly payments from the investor managing the note and won’t have to worry about much else. However, every situation is unique so always do your research.

Strategy: Purchasing Partials

A partial note is exactly what it sounds like: part of a whole note. Hence, the sale of a note partial is when one note investor sells a portion of payments to another investor. In our case, this Rather Passive strategy is the partial purchase of an already existing note. It differs from hypothecation in that you are likely taking legal ownership of part of the note. The partial buyer may even manage the day-to-day oversight of the note for the time period in which they are receiving payments.

Partial agreements can be structured in many different ways, but in general the risk profile and passiveness level associated with buying partials are very similar to those of participating in a hypothecation. If you’re looking for more details about partials, read this great article written by Josh Andrews of Notable Capital here. All in all, buying partials can be a Rather Passive way to go.

Jamie’s comments: In my experience selling (and buying) partials, this works best for someone who wants to have some skin in the note game and may want to scale their note business in the future, or for someone who has “been there, done that” and is simply looking for cash flow.

Strategy: Partnering with an Experienced Investor through a Joint Venture

A third Rather Passive strategy is partnering with an experienced note investor on a non-performing loan (NPL) through a Joint Venture (JV) deal. This can be a great option for someone who is interested in getting their feet wet before buying their own notes. As always, it is critical to know and trust anyone you send money to. Often, the non-experienced partner is the “money” partner and will supply most or all of the funds to purchase the asset and are involved in making major decisions regarding the asset.

However, the money partner is not typically involved with managing the NPL on a daily basis. This Rather Passive strategy usually involves more upside potential than hypothecation or partials, but can also come with increased risk. As stated previously, it is also a valuable learning opportunity as the non-experienced partner can work closely with an experienced investor on a NPL. If you see yourself investing in NPLs in the future, consider starting off by being a money partner on a properly structured JV deal.

Jamie’s comments: Being the money partner in a JV can work well for someone who is younger and is willing to take on some more risk in order to allow for a higher return. Using a self-directed IRA can be a decent option for this.

Stage 3: Somewhat Passive

Strategy: Purchasing Performing Notes

Stage 3 is the first of the strategies that differentiate the truly passive note investors from the individuals that see note investing as an opportunity for a side or full-time business. Stages 1 and 2 relied on other note investors to actually purchase the assets. In this stage, however, you are the sole owner of the asset.

The process for purchasing performing notes is quite different than stages 1 and 2. First, you need to find a source for performing notes. These sources include, but aren’t limited to: note brokers, hedge funds, other note investors, and online exchanges (www.paperstac.com, for example). Next, you need some sort of purchasing criteria. For example, you’ll want to define your target states, lien position (senior or junior), a range for the unpaid principal balance of the loan, notes or CFDs, target yield, etc. In order to calculate your target yields you’ll want to have a calculator that takes into account the future cash flow and expenses of the notes. After you get an accepted offer on a note, you’ll need to complete extensive due diligence on the paper asset, the borrower, as well as the physical property. Once the due diligence is completed without any show-stoppers, it is time to close on the deal.

At this stage it is likely you’ll want to start building a support team that includes, but is not limited to: attorneys, servicing companies, title companies, and maybe even a bookkeeper. Investors often have LLCs or other entities that are used to purchase performing notes to decrease potential personal liability from these assets.

Another thing that’s critical at this stage is understanding your exit strategies. Will you just collect the monthly payments if the note continues to perform, or would you consider selling partial payment to another investor like we discussed in Stage 2? If the note becomes non-performing, what approach will you take to get the borrower back on track? If you end up taking back the physical property, is your plan to rehab and sell at full retail, or sell it off as soon as possible to another investor? These are all important questions to ask yourself during your analysis as you want to be confident that you can make a profit with your worst-case exit strategy.

Jamie’s comments: While I recommend note investors get educated before jumping in and buying whole notes, I know I learn by doing. Buying your first note can be both exciting and educational.

Stage 4: Rather Active

Strategy: Purchasing Non-Performing Note

A non-performing note (for this discussion, we are including sub-performing notes) is a note that the borrower is either behind in making their payments, or not making their payments at all. A non-performing note is often defined as a loan where the borrower is 90 days behind or more on their payments. A sub-performing note may be defined as a loan where the borrower is actively making payments, but they are behind a bit or have missed payments in the recent past. If the borrower is not making payments when the note is purchased, there is obviously no initial cash flow from the asset. Non-performing notes are purchased at higher discounts than performing notes, typically between 30-60% of UPB compared to 75-95% for performing notes. The due diligence for non-performing notes is very similar to a performing note, except each step may be more involved and it is critical to properly evaluate the property value as there’s a higher chance that the investor could end up with the property.

The main reason why non-performing notes are in Stage 4 instead of Stage 3 like performing notes is the investor may have to work with the borrower to get the note reperforming, or work with a servicer and/or attorney to initiate foreclosure or otherwise take back the property. It is much more important on a non-performing note to understand your different exit strategies. Some investors target vacant houses in hopes of foreclosing, while others want to work with the borrow as much as possible in order to get the loan back to current and turn it into a performing note.

Since performing notes are worth more to other investors, turning non-performers into performers is a common way that note investors generate profit and scale their businesses. Another reason why non-performing notes are in Stage 4 (Rather Active) is that the asset management is much more involved than it is for a performing note. Asset management in this case refers to monitoring your 3rd party vendors, working with your legal team, paying property taxes, etc. You may need to be creative here. All-in-all, non-performing notes are quite a bit more active than their performing counterparts.

Jamie’s comments: This is where the fun begins. While buying NPLs may sound riskier on the surface (and it certainly can be risky), if you buy a performer and the borrower stops paying, you just paid way too much for a non-performing note. Buying at a steep discount can mitigate a lot of that risk.

Strategy: Creating Notes

The second Rather Active strategy is creating your own notes, which is typically done via seller financing. An example might be purchasing a home with cash for a discount, rehabbing it, and then selling the property to a home buyer with seller financing. Instead of the buyer making monthly payments to a bank, they would simply make the payments to you. You now have the choice to continue to receive monthly payments from the borrower, or sell the performing note to other note investors.

There are a few reasons why we’re considering this as a Rather Active strategy. First, you need to find a property and most likely purchase with cash. A rehab of this property is often required before selling the property. After the renovation you’ll need to find a buyer for the property, and most of the time, buyers interested in seller financing won’t be able to qualify for traditional financing. This may be due to their employment situation, credit history, or the fact that the loan amount may be smaller than that of a typical bank mortgage. Therefore, buyer/borrower screening becomes an important step with seller financing.

You also need to properly underwrite the new loan to be sure it is compliant (Dodd Frank/CFPB/SAFE Act). The regulations around creating a new loan can be state dependent and you may want to involve a licensed loan originator (RMLO), underwriter, and/or attorney before doing so. Again, after the loan is created you have the choice of receiving monthly payments or selling the note for a profit to other investors. Many investors choose to sell these newly originated notes in order to get their money back to work buying more properties and creating more notes. As you can see, there are many moving parts with this strategy. Hence, we deemed it Rather Active.

Jamie’s comments: While our business model has not focused on creating notes, many experts in the note world believe this strategy will become increasing important to understand given current market conditions. Banks and lending institutions have tightened their criteria recently, and we may see more REOs in the next 12 to 24 months, so understanding how to combine real estate and notes will probably be quite profitable for many investors.

Stage 5: Very Active

Strategy: Managing a JV on an NPL

The first strategy for Stage 5 (Very Active) is managing a joint venture (JV) on a non-performing note. This involves all of the complexities of purchasing a non-performing note as discussed in Stage 4, and now the investor is also working with and reporting to a JV partner.

There are many considerations to account for when deciding to take on a JV partner. First, there is a legal contract between the two JV partners that outlines the relationship between the parties. This requires consultation with a quality attorney familiar with these arrangements. Often times, there is a “money” partner, who supplies all or most of the funds to purchase the note (as discussed above), and an “operating” or “managing” partner, who manages the day-to-day aspects of the asset. Larger decisions typically need input from both parties. The managing partner now must keep track of the bookkeeping, payments to the JV partner, as well as regular reporting (often at least quarterly).

Another challenge to a JV partnership is that typically the money and the deal have to coincide. In other words, you don’t want to bid on an asset if you don’t have a funding partner lined up, but you don’t want to take someone’s funds without an asset to put them toward. This can be like—as a teenager–having to get a job you need to drive to, so that you can afford to buy a car. Which comes first? As you can see, even just the purchase of a non-performing note with a JV partner could be considered Very Active. In contrast, if you’re an investor selling partials, normally the note is already purchased and the money is found later.

Jamie’s comments: For many note investors, managing a JV deal can be the first time they take someone else’s money to manage. In my opinion, JVs tend to work best on NPLs because there is often a rather well-defined exit point. Doing a JV on a performing note is certainly possible, but I have found partials to work better in that scenario.

Strategy: Managing a Fund

The last strategy, and the second for Stage 5 (Very Active) involves managing a note fund. This is where an investor is raising capital for large scale purchasing of many assets. For example, a typical note fund could be targeting between $1 million and $10 million of raised capital. A fund isn’t cheap to launch – oftentimes startup costs can be between $5k and $10k—this is just to open the fund. Funds also open the door to a variety of different regulations. This can vary between funds, but some examples are 506(b), 506(c), and Regulation A. Managing a fund also comes with the responsibility of reporting to all of the investors in the fund. Interestingly enough, depending on the relative size of the fund, reporting to fund investors can be less work than reporting to many individual JV partners. As such, managing 100 assets (whether performing or not) in a fund is likely less work than managing 100 JV deals. Regardless, managing a note fund is certainly on the Very Active end of the passiveness spectrum.

Jamie’s comments: While we are not currently at the point of running a fund, it is something we may look to in the future.

————

The graphic below depicts how two investors can work together to achieve mutually beneficial goals. For example, if a note investor working along the top spectrum wants to remain passive, they can partner with an investor along the bottom who takes an active approach. Conversely, if an investor on the top wants to take an active approach to notes, they can work with an investor who uses a passive strategy shown along the bottom spectrum.

There are many ways to get involved in note investing. The first step in the process is understanding what your goals are, as that will initially determine what stage of note investing best suits you. If you’re simply looking to diversify your capital outside of the stock market, consider investing in a note fund (Stage 1), purchasing a partial (Stage 2), or utilizing hypothecation (Stage 2). However, if you think that note investing is something that you really want to learn and pursue a more active role, consider starting out as a money partner in a JV deal (Stage 2), or purchasing a performing note (Stage 3) and work your way through the stages as you see fit. Regardless of your goals, note investing is an investing strategy that can work for many.

So, is note investing passive? Like many things in life, it depends.