Infinite banking has been a central strategy in our ability to grow our note business in the last couple of years. To find out why and how we do this, and whether this powerful technique could help you as well, read on!

What is Infinite Banking?

The Infinite Banking Concept (IBC) is a philosophy and process developed by the late Nelson Nash where individuals can take control of their own cash flows and essentially become their own banker. Although there are many variables in how this can be applied, the financial vehicle used most commonly with this system happens to be high-cash-value, dividend-paying, whole-life insurance. One critical piece of this—and something many people miss—is that in order for this to work optimally, the policy must be specifically designed with IBC in mind. Many life insurance policies simply would not work well with this strategy.

Once the life insurance policy is established (whether on yourself, your spouse, or someone else), you as the owner of the policy use the cash value of the policy as collateral to borrow money from the life insurance company. Remarkably, if the policy was properly designed, not only does the cash value in the policy continues to grow, the funds obtained as a loan can be used in any way the policy owner sees fit. Most of these life insurance companies have been in business and consistently paying dividends for over 100 years. In fact, some are older than the IRS, and much older than the 401(k). There is a reason that banks own $190 billion in life insurance (BOLI). But I digress.

IBC is by no means a get-rich-quick scheme. But if used properly for the long term, it is a way that responsible, disciplined people can take control of their finances and become less reliant on big banks. It is also a way to quickly get access to capital when you need it with no questions asked. This capital can be used to fund investments, businesses, or college educations. It can be used to purchase vehicles or even vacations—all while the policy itself keeps growing in value.

What does this have to do with note investing? Let’s dive in.

The Three Parts of a Note Business

In its simplest form, running a note business boils down to three activities:

- finding assets,

- managing assets, and

- finding money to buy assets.

Obviously, note investors need to have access to notes to buy. If you want to run a business investing in mortgage notes, buying and selling notes is the backbone of your business. The notes themselves are the commodities or assets you are investing in and trading. And lately, given today’s market conditions, finding these assets seems to be more and more of a challenge. For more information on sourcing notes, read this article.

Managing the notes you purchase is the second central piece to this business. This is where working with your servicers, attorneys, vendors, and borrowers, as well as planning your exit strategy for each note, is paramount. If you can’t manage your systems well enough to receive cash flow from your performing notes and add value in order to profit from your non-performing notes, you won’t make it in this business. Asset management is crucial.

Last, but not necessarily least, is the challenge of finding money. It doesn’t matter how deep your own pockets are, you will run out of your own money if you are trying to scale your note business. Even if you have quality, consistent deal flow and you are a competent asset manager, at some point you’ll need to find more capital to acquire more notes. This is where infinite banking can help.

Where To Find Money

Note investing is a capital-intensive undertaking. And it is very unlikely that you, as a small-time note investor, can walk into a bank and ask for a loan to go buy a note. As such, what are your options? Here are three potential sources of money:

- Personal funds. This is rather self-explanatory. However, I do recommend you build a track record and a foundation of experience using your own money before putting someone else’s at risk.

- Other people’s money. This could be by way of joint ventures, partials, hypothecation, note funds, etc. For an in-depth breakdown of these techniques, read our article here.

- Infinite banking. Read on to learn how we use IBC to fund our note business.

How We Use IBC to Fund our Note Business

In our business, we have used our own funds as well as other people’s money through joint ventures and partials, and we will likely look to managing a note fund in the future. With that said, a vital piece to our business growth has also been our use of IBC. How so? Well, this is how we do it.

- Actually two loans. First, we (personally) borrow money against our policy. This is done very easily and quickly.

- IBC flow-through account. The funds from the life-insurance company are deposited into a personal account we have established only for this use.

- Second loan. Our note company then borrows money from us. The funds are transferred from our IBC flow-through account into our business account.

- Meeting minutes, amortization schedule. The loan to our note entity is formally documented and structured. There is a clearly defined payment plan for the business to pay back the loan with payments back to our IBC flow-through account.

- Determining loan terms from self to business. Nelson Nash recommended paying back the loan to the insurance company at a higher rate than the rate the insurance company charges you, so that is what we do. However, we structure the loan repayment so that we are earning more interest with this money in our note business than we pay back each month. For the most part, we have structured our loans to be amortized over 10 years at either 5% or 6%. This is a form of arbitrage. If we could not make more than this 5% or 6% in our note business, this strategy would probably make no sense.

- Automatic payments. We use the “bill pay” feature through our bank to set up automatic payments from our IBC flow through account back to the insurance company to pay down the original loan.

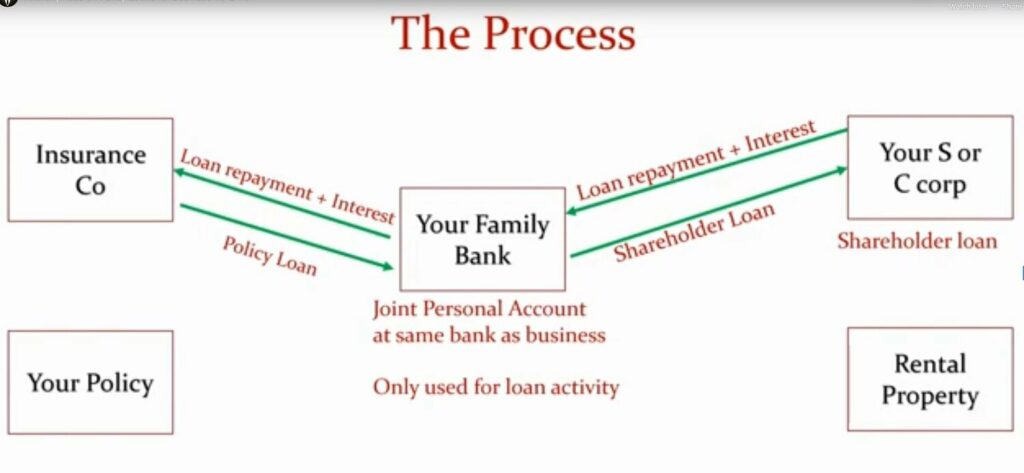

If the above section was confusing, see the graphic below. (To be clear, this was not our graphic—it is from Anthony Faso of Infinite Wealth Consultants—but I found it quite helpful in visualizing this process. In this example, the graphic shows a rental property, but the same principles apply. If you have specific questions about this, I highly recommend you contact Wealth Without Wall Street and/or Infinite Wealth Consultants.)

Advantages over Other Sources of Money

Here are a few advantages to using an IBC loan over using other people’s money or a traditional bank loan:

- Flexibility and control. You can set up the payment schedule how you want but you can also change it if need be. Let’s say your note business takes a turn for the worse. For example, hypothetically speaking, there is a global pandemic and ensuing foreclosure moratoria that cause your business to be less profitable than you had anticipated. Well, you can halt or lower your loan payments (both from your business back to yourself AND from yourself back to the insurance company). You are in control here and you have options. If you die with an outstanding loan balance, the insurance company will simply deduct the money you owe them from the death benefit paid out to your beneficiaries.

- No reporting. When you manage a note fund or participate in joint ventures, your investors and JV partners are going to want some level of involvement and reporting to them. If you were them, wouldn’t you want to know what is going on with your investment? Well, this requires some level of effort and time on your part. Not so with a policy loan. There is no reporting to the insurance company about what you did with the money or how their investment is performing. Once this is set up, there is not much work at all.

- No application. Unlike applying for a bank loan (for example, a mortgage), there is no application. The insurance company (of which the policy holder is a (mutual) co-owner) is contractually obligated to provide the loan. You tell the insurance company where and when to send you the money, and then you pay them back. This is typically done in a matter of days without any real hassle.

- Opportunity cost. When you use your own cash to purchase notes, that cash is not being used elsewhere. It is tied up. In contrast, if you use that same cash to start a properly structured, life-insurance policy, and then you borrow against that policy to purchase notes, most of that initial cash outlay is now earning money for you inside the policy. It can take a few years for the policy growth to really start to pick up momentum, so the earlier you can start the policy, the better.

Final Thoughts

As you can see, infinite banking can be a powerful tool to fund your note-investing business. Is it for everyone? No, probably not. Just about everything in life has a drawback or cost. But it is certainly proving to be an essential strategy in our business model and long-term growth.

Check out our podcast episode where we interviewed Russ Morgan and Joey Mure of Wealth Without Wall Street here. Russ and Joey are experts at implementing IBC to fund their many businesses.