Think you need six figures to start with real estate notes? Not necessarily. You can begin smaller—then use smart capital strategies to scale. Here’s what you really need, plus practical ways to get started.

The General Rule for Getting Started with Real Estate Notes

To operate meaningfully, most new investors do well with $25,000–$50,000. That range typically lets you:

- Buy in the first-lien space, where there’s far more inventory

- Maintain a cushion for legal/servicing/BPO/recording costs

- Sell a partial later to recycle capital and buy another note

Don’t Have $25K Yet? Viable Ways to Start Smaller

Asset Paths (What You Can Buy)

Real example:

One case study turned a very small purchase into a sizable outcome. Watch it below:

Access to Capital (How to Fund & Scale)

- Brokering Notes Save Cash — Earn fees matching buyers/sellers; great way to build capital before buying.

- Sell a Partial / Hypothecation — If you own a note, sell a payment stream to free up cash and go buy another.

- Joint Ventures (JVs) — Common on non-performing notes when you have the skill but not the capital.

- HELOC — Lower rates vs. unsecured debt; remember your home secures it. Use prudently.

- Funds (Advanced) — For experienced operators; structure and compliance required.

- Infinite Banking — Optional strategy some investors use; understand mechanics before deploying.

Deeper dive: Watch our presentation on Active↔Passive Spectrum below.

Why $25K–$50K Often Makes Sense

- Opens up the first-lien market (more inventory and typically more predictable outcomes)

- Lets you budget properly for servicing, collateral review, legal, BPOs

- Enables sell-a-partial strategies to recycle capital

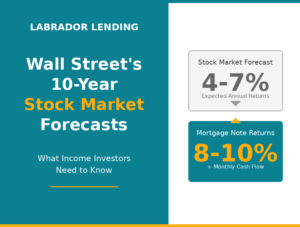

What Kind of Returns Can You Target?

Ranges vary by effort, risk, underwriting, and market. As high-level guidance:

- Performing first-liens: ~10–12% target ranges are common for many investors

- Non-performing workouts: ~10–25%+ depending on resolution path and timeline

- Seconds: can be higher than firsts but with higher variance and risk

- Partials / funds / more hands-off: typically steadier and lower than active workouts

Educational content only—not financial advice. Outcomes vary. Capital is at risk and returns are not guaranteed.

Effort vs. Outcome (Quick View)

Is Note Investing Right for You?

- Experience: Real estate, lending, workout, or analytical background helps—beginners can learn with guidance

- Risk tolerance & time: More active strategies demand both

- Capital plan: Cash on hand, plus a strategy to grow it (brokering, JVs, selling partials)

Operational help matters. Consider loan-servicing/ops experts like Shante Duffy, part of the Labrador Lending Mentorship Program when scaling.

About the Labrador Lending Note Investing Mentorship Program

Get practical, one-on-one guidance tailored to your goals—from sourcing and underwriting through workout strategies and scaling with other people’s capital.

What You’ll Get

- ✅ Personalized sessions focused on your next best move

- ✅ Access to a trusted, real-world network (servicers, attorneys, vendors)

- ✅ Pay-as-you-go pricing—no big upfront commitment

- ✅ $150/hour with a three-session minimum

Additional Resources

Free eBooks

Visit our website to explore more investor tools and educational resources.

The Power of Mortgage Note Investing

The Power of Mortgage Note Investing AI-Powered Note Investing in 2025 and Beyond

AI-Powered Note Investing in 2025 and Beyond Foreclosure Reference Pack

Foreclosure Reference Pack Step-by-Step Guide to Buying a Mortgage Note

Step-by-Step Guide to Buying a Mortgage Note