Investing has always been a pathway to financial freedom, but not all investments are created equal. For investors seeking steady, reliable passive income, mortgage note funds present a compelling opportunity. In this blog post, we’ll explore how passive investors can leverage mortgage notes through a mortgage note fund to create diversified income streams while minimizing the hands-on effort typically required in real estate investing.

What Is Passive Income?

Passive income is money earned with minimal active involvement. For investors, this could mean receiving monthly payments from rental properties, dividends, or investments in mortgage notes. Unlike active income, which demands consistent effort, passive income allows your capital to work for you while you focus on other priorities.

What Makes a Great Passive Income Investment?

Not all passive income strategies are created equal. Whether you’re new to passive investing or looking to improve or diversify your portfolio, it helps to know the key traits of a high-performing, truly passive income opportunity:

- Monthly Cash Flow: Look for investments that provide consistent monthly distributions—helping you cover expenses or reinvest steadily, without waiting years to see returns.

- Low Maintenance: The best passive income streams don’t require hands-on involvement. Skip the daily oversight, tenant calls, or trying to time the market.

- Asset-Backed Security: Opportunities backed by real estate or other tangible assets tend to offer greater stability and downside protection compared to unsecured options.

- Reliable, Consistent Returns: Rather than chasing high-risk growth, seek income-focused investments with a track record of delivering predictable returns—even in uncertain markets.

- Experienced Management: A trusted team handling the heavy lifting lets you remain hands-off and confident.

For accredited investors, mortgage note funds can be a smart, secure way to generate real passive income.

Understanding Mortgage Notes

Mortgage notes represent loans made to borrowers, secured by real estate as collateral. As the lender (or note holder), you receive the borrower’s monthly mortgage payments, which include interest—a key source of passive income. Mortgage notes can offer higher returns compared to traditional fixed-income investments, making them attractive to passive investors.

Why Mortgage Notes Are Ideal for Passive Investors

- Consistency: Payments from mortgage notes often provide reliable monthly income.

- Security: Notes are backed by real estate, offering a layer of protection for your investment.

- Flexibility: You can invest in notes that align with your risk tolerance and financial goals.

What Is a Mortgage Note Fund?

A mortgage note fund pools capital from multiple investors to acquire a diversified portfolio of mortgage notes. This structure offers several advantages:

- Diversification: Spread risk across various notes, borrowers, states, and properties.

- Professional Management: Experts handle the capital management, due diligence, note acquisition, vendor management, and asset sale, ensuring a hassle-free experience for passive investors.

- Steady Returns: Funds often provide predictable, targeted returns, making them an excellent choice for investors focused on generating passive income.

The Labrador Lending Integrity Income Fund

At Labrador Lending, we’ve designed the Integrity Income Fund to meet the needs of accredited investors who want to earn steady passive income through mortgage notes. Here’s what sets us apart:

- Targeted Returns: Accredited investors contributing $100K or more can enjoy a targeted 10% annual return, paid monthly. While accredited investors contributing between $25,000 and $100,000 can enjoy a targeted 8% annual return, paid monthly.

- Real Estate-Backed Investments: Nearly all notes in the fund are secured by first-lien mortgage notes on residential properties, providing a stable foundation for your portfolio.

- Hassle-Free Experience: Our expert team manages all aspects of the fund, allowing you to enjoy passive income without the stress of active management.

- Short Commitment: With a unique 12-month commitment, the fund offers liquidity most other funds simply do not offer, allowing you to have options for your money in the near future.

Who Should Invest in Mortgage Note Funds?

Mortgage note funds can be tailored for investors seeking:

- Often predictable, passive income streams.

- Lower-risk investments compared to stocks or non-secured options.

- Professional management to reduce the complexities of real estate investing.

- A way to diversify their portfolio without direct property ownership.

Why Accredited Investors Prefer Passive Investing

Passive investing appeals to accredited investors because it aligns with their need for time-efficient, reliable income strategies. Mortgage notes and note funds can meet these needs by offering:

- Minimal Effort: Professionals handle the hard work, allowing you to enjoy financial freedom.

- Financial Security: Real estate-backed investments add a layer of protection and diversification.

- Attractive Returns: Returns often outperform other passive income options.

How to Get Started with Labrador Lending

Becoming a passive investor in mortgage notes is easier than you might think. At Labrador Lending, we guide you through every step, from understanding the benefits of mortgage note funds to investing in the Integrity Income Fund.

Our fund is open exclusively to accredited investors, offering:

- A $25,000 minimum investment for entry.

- Monthly distributions that deliver steady income.

- Expert management focused on transparency and success.

Final Thoughts: Unlocking Passive Income with Mortgage Note Funds

For investors seeking to build consistent, hands-free income, mortgage note funds offer a compelling solution. By investing in a professionally managed note fund, you gain access to an alternative asset class designed to generate steady monthly income, add diversification to your portfolio, and weather market fluctuations—all without the day-to-day management of traditional real estate.

With the potential for reliable cash flow and wealth building, mortgage note funds are an ideal strategy for those focused on passive income and financial stability.

Ready to make your money work harder and smarter? Discover how our mortgage note fund at Labrador Lending can support your passive income goals.

Click below to explore our mortgage note fund opportunity for passive investors at Labrador Lending.

Note Investing Mentorship & Educational Resources

Note Investing Mentorship Program

Interested in more in-depth note investing education? Explore Labrador Lending’s Note Investing Mentorship Program.

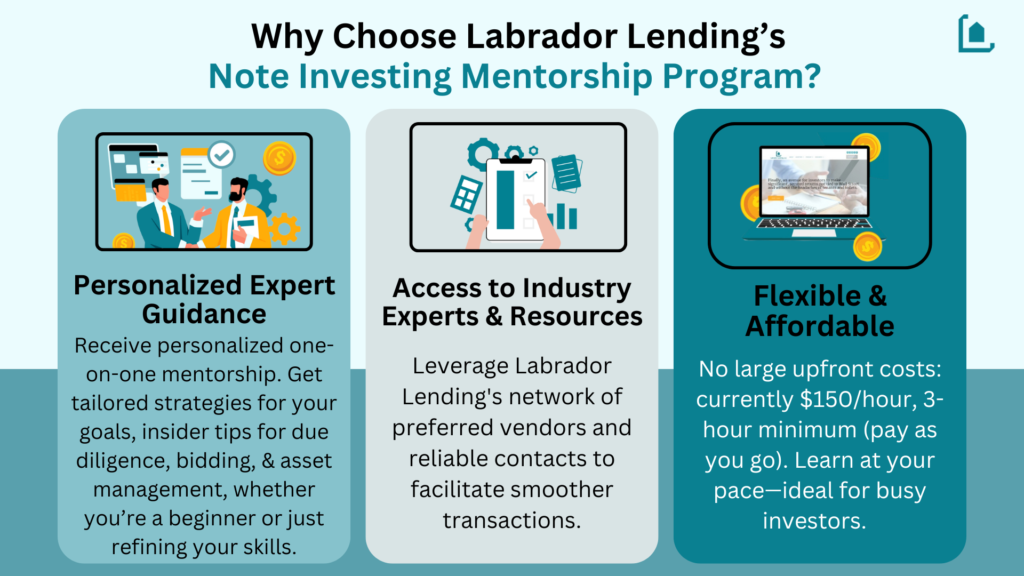

With Labrador Lending’s Note Investing Mentorship Program, you get:

- Personalized one-on-one guidance

- Access to trusted industry experts & resources

- Flexible, pay-as-you-go pricing—no big upfront costs! Sessions are currently $150/hr with a 3-hour or 3 session minimum.

Free Ebook Resource: The Power of Mortgage Note Investing

Get our free 5-chapter, 74-page eBook packed with real-life case studies and proven strategies. Learn how to generate passive income, become the bank, and diversify your portfolio through mortgage note investing—no experience required.

Disclaimer: This content is for educational purposes only and should not be considered legal, financial, or tax advice. Always consult with a qualified professional before making any investment decisions.